A classic 5x opportunity template

Looking beyond what is made available from companies can help in the current bull market

We are currently in a ferocious bull market. Anything that can potentially be gold, is considered and valued as a diamond (Natural diamond of course). In such a market, finding a company that offers minimal downside but offers huge upside is not only tough but I believe it will be near to impossible. The only exception to this will be to look at a segment which no one else is looking at or willing to look at due to various factors. These companies won't be doing calls or releasing earnings releases or corporate presentations. There is also an implicit risk of getting struck in value traps since in a bull market, 'most' of the cheap companies are cheap for a reason.

People who have interacted with me in the past know that I don't belong to value investing or growth investing camp. I would rather bucket myself in Perception Investing (Buying bad perception and selling good, will write about it later). I invest in companies which are 1) cheap but there are triggers for value unlocking and 2) where perception can change for the better. While the former factor is fundamental one and is important for accounting statements improvements, it is the latter that leads to multiple rerating along with the underlying growth.

The purpose of this post is not to share an investment opportunity, but to highlight a company which I have been actively buying and building one of my core positions (even in this current bull market). For obvious reasons, I will not be naming the company and would request readers to also not to ask. I am writing this post to nudge you to look beyond what is made available from the company (since everyone has access to this) but read what nobody or the majority of the street doesn’t read. In this case, it is the notes given in the financial results and annual reports.

(The figures quoted below have been changed but the quantum has been kept the same)

XYZ Ltd is one of the oldest engineering companies which operates mainly in two segments - 1) Capital goods provider to the iron and steel industry and 2) Steel pipes. The company was an NPA case due to past mismanagement and at one point had a gross debt of around 3500cr on its balance sheet. During the 2015 to 2018 banking cleanup, many banks sold this debt to various ARCs at throwaway prices. Various banks classified the company as a wilful defaulter and fraud. There were cases against the company and its directors by CBI on funds misappropriation.

All this while, the two segments were growing and the company doubled its turnover from FY 15 to FY 18. However, the EBTIDA was shown negative to low single digit while the companies in a similar space were reporting mid-double-digit margins. The turnover was halved during the FY18 to FY20 period but the underlying assets, customers, employees and quality were maintained well by the company.

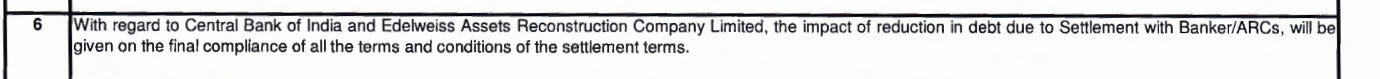

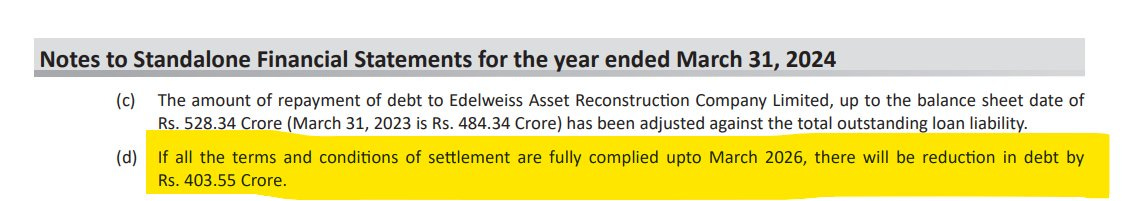

Fast forward to today, the company has successfully been able to get OTS (one-time settlement) with most of its bankers and ARCs barring one. The total debt on the books is now 2000cr, however, this debt in my analysis is overstated by around 1000cr. As per the below notes to accounts, the company can not report reduced debt unless all the terms of the OTS are successfully met.

The real reduced debt of around 1000cr will be shown in March 2026 (If the company fulfils all the obligations of OTS which it can easily do given the current EBITDA run rate).

Further, the two segments have surpassed their previous peak sales and the current reported margins are in line with the peers and are double the peak margins. Based on the current market cap, true debt on the balance sheet and normalised quarterly margins, the company seems to be trading at the EV/EBITDA of 3.3 Vs the reported unadjusted of around 6.

Both the segments are growing in double digits and there is sufficient reason to believe that growth will continue to be there. For one of the businesses, I checked with a couple of promoters who own companies in the iron and steel segment - got a very good feedback from these. I visited the dealers for the other division and got to know various initiatives being taken by the company.

The company operating in similar segments are getting EV/EBITDA of 15-20x. Even if I give a 10x EV/EBITDA multiple to this and assume EBITDA to grow at 10%, the potential upside is upwards of 5x for the equity. More importantly, no one is tracking this company, no discussion on Valuepickr or Twitter (ya now X), it can rerate massively in a very quick period.

Disclaimer: Invested and building position.

Is that jayaswal neco ?