Asymmetric Opportunities in Indian Auto Sector

We find 2-wheeler auto ancillary companies attractive

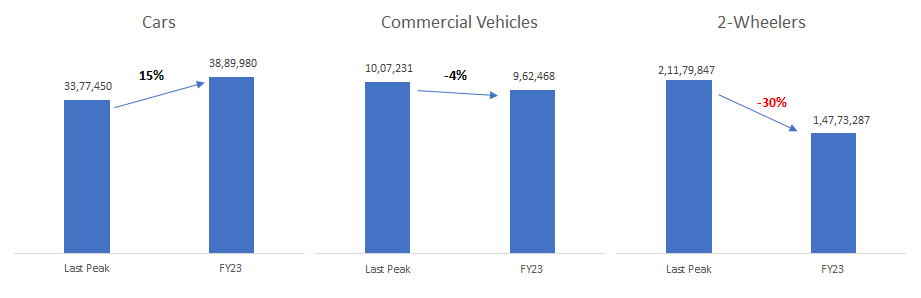

The auto sector is a cyclical sector with large swings in volumes from upcycle to downcycle. However, due to low penetration in India and sustainable replacement demand, we like to buy auto companies (OEMs and auto ancillaries) when the sector is going through a bad phase. FY19 to FY22 was a bad period for the entire auto sector where volume for PVs (Cars), 2-wheelers and CVs declined from their respective peak volumes. FY23 was a year when PVs and CV regained their peak volumes. However, 2-wheeler volumes in FY23 were still 30% down from their peak (as shown below):

Considering CV and PV volumes have recovered and overall these two sub-sectors are reporting good performance, risk-reward in companies which are related to these two sub-sectors are not looking so great since stock prices of these companies are reflecting this recovery and good performance.

However, as shown above, 2-wheeler is the only segment in the auto sector which is yet to recover and the same is also true for the stock prices of companies related to the 2-wheeler industry. Due to this, it becomes imperative for value-conscious investors like ourselves to spend more time on the 2-wheeler side of the auto sector.

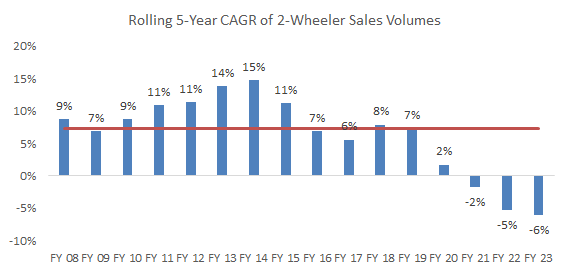

To understand where we are in the cycle for the 2-wheelers, we show below the rolling 5-year CAGR performance for the last 15 years of domestic 2-wheeler sales volumes:

As shown above, the current time period is not only the first time when 2-W segment has de-grown on a 5-year CAGR basis but FY23 was the third consecutive year to register de-growth.

One important reason that can be ascribed to this underperformance is rural India, which contributes 55% of 2-wheeler sales, has not been doing well since Covid. Due to this, the base for the 2-wheeler industry has become low and we feel that when the rural demand turnaround, 2-wheeler players can see a strong recovery in volumes. With this recovery, all the 2-wheeler-related companies (OEMs and ancillaries) can see a healthy recovery in their revenues, margins and profitability. On this recovered volume and profitability, the valuations of these companies look attractive to us.

Recent quarterly results and commentaries from microfinance companies and NBFCs that operate in rural India indicate recovery in rural areas and this augers well for the 2-wheeler segment. We believe that it is only a matter of time for the 2-wheeler segment recovery to start.

To play this recovery, we are evaluating companies who supply to 2-wheeler OEMs and are engine agnostic (companies who supply products which find application in both ICE as well as EV like shock absorbers, headlamps, brakes, aesthetics etc).