Curious Case of the Hotel Property of Cineline India Ltd

Going into the past transaction details uncovers the bad transaction contours

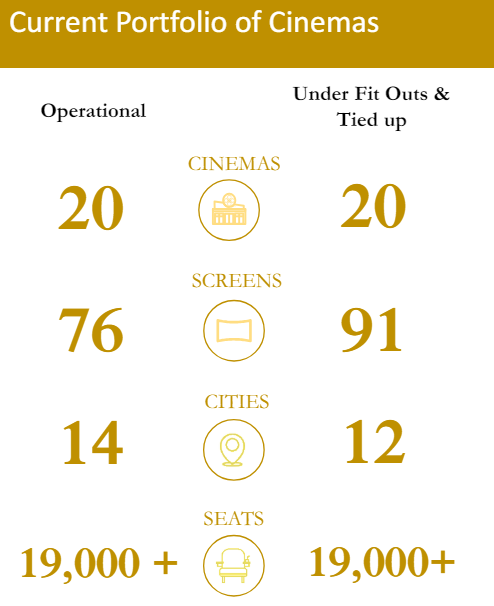

Recently we came across an interesting company in the movie exhibition space which is talking about substantial expansion in its screen addition. The promoters have a very good commercial real estate background and had earlier in 2008 to 2012 built and sold a movie exhibition business to PVR. Post the ending of the non-compete period as per their agreement with PVR, the promoters have now again ventured into the movie exhibition space via the listed company Cineline India Ltd. Below snapshot from their Q4 FY 24 presentation gives a good glimpse on their screen addition plans:

What is interesting is that the market cap of Cineline India is INR 430Cr with a net debt of around INR 220Cr leading to the enterprise value (EV) of INR 650Cr. The company holds a hotel property in Goa (Hyatt Candolim) which is valued at around INR 270Cr (as per the Q4 FY24 result press release). As per the Q4 FY24 press release, the company intends to sell this hotel property in FY25. If they are successful in selling this property, the company's consolidated net debt of 220cr will become net cash of around INR 50cr (INR 220Cr of debt + INR 270cr of realisation assuming no tax implication). Post this, the EV should be INR 380Cr with 50Cr of cash and debt being zero giving substantial headroom to the company to undertake the aggressive expansion as shown in the above excerpt.

The purpose of this post is not to tout Cineline India Ltd as an investment idea of it becoming a large multiplex chain. Our purpose is to highlight the incidence of a major financial loss that was caused to Cineline India Ltd and its minority shareholders via this hotel property transaction.

Cineline India Ltd acquired R&H Spaces Pvt ltd (the company holding the hotel property) in Nov 2020 (press release link: https://www.bseindia.com/xml-data/corpfiling/AttachHis/a3332ec8-c2ad-411c-840e-2efb4829be45.pdf). Here are a few snapshots from this press release highlighting the red flags:

As mentioned in the press release, the hotel property was owned by Kanakia Hotel & Resorts Pvt Ltd, a related party to the promoters. Moving on to the consideration and valuation of this property:

Further, the valuation at which Cineline acquired this hotel was at INR 334Cr. Now this transaction was announced in Nov 2020 when due to Covid the entire hospitality sector was in shambles. We compared the valuations of this transaction with the other two bigger listed companies - Indian Hotels and EIH Ltd, as shown below:

As shown above, Hyatt was acquired at obscene multiples as compared to what the much bigger and better managed hotel companies were trading at.

Fast forward to the present, the company itself is valuing this property at the EV of INR 270Cr (Vs INR 334 Cr paid around 4 years back) as per its latest result press release (https://www.bseindia.com/xml-data/corpfiling/AttachHis/e9409cac-b61c-47ec-8706-d85f539f852b.pdf).

Based on this, the company Cineline India Ltd stands to loose INR 64Cr of absolute loss + an opportunity cost of INR 84Cr (at a 7% per year rate, bigger loss if you think the company could have invested in any equity MF).

From the current juncture, it is very much possible that Cineline India will be able to execute its aggressive screen addition plans with the proceeds that it will get from the hotel sale and it might be able to create value for its shareholders. However, one should keep in mind the above incident in mind before choosing to invest here.

Disclaimer: We do not own Cineline India Ltd in our portfolio. We do not recommend selling or buying Cineline India Ltd, please consult your financial advisor before making any buying or selling decision.