Investment Idea in the Current Bull Market

A slow growth company increasing its capacity to 3x in fast growing import dominated market

In a full-blown bull market like the current one, all the small-cap companies supposedly look very interesting and highly alpha-generating. I believe that most money is lost in a bull market and most money is made in a bear market. This contrarian thinking comes from the thought that investors are generally loose with their risk management policies in the bull market and are extra risk averse in the bear market. Warren Buffett has aptly said - "The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.”

Having set the above context, I have raised the bar for researching any stock (especially Small cap stocks) and I demand a much higher risk reward than the normal. One company that I have recently added to our clients’ portfolio fulfils these stringent criteria and does promise a sufficient margin of safety at current prices while offering a very good upside.

Due to SEBI regulations, I am not permitted to name our investments in the public domain. This is anyways not the purpose of this article also. The purpose here is to share my thought process when evaluating a company in a ravenous bull market like the current one.

The company operates in manufacturing the high-end films which find their application in the manufacturing of capacitors presently. However, the same product is also used in Electric Vehicles and Solar power panels which is where the demand for these films is growing at a good pace.

The company is the only Indian company operating in this segment and has 30% of the market share in India. The remaining 70% is met with imports. The company has access to the majority of the customers in India who require these films in their production. The product is technically challenging to manufacture and requires very stringent quality checks. Globally there are only 6-7 players in the manufacturing of this product with 40 production lines. Further, there are two companies that provide requisite machinery to manufacture these films and that's why it takes 3-4 years for a new line to come on board.

The company has not done any major capex in the last 10 years owing to it being not so growth-oriented. However considering the potentially huge demand from EV, Solar, and other electronic segments, the company has now embarked upon a very aggressive capex to take its current capacity to 3x by FY26. Post this expansion, the company would own the capacity to meet ~70% of Indian demand from the current 30-33%. Further, the new lines would manufacture even more technical films which would command 2x to 3x higher realisations. Management is highly confident of running these new lines at optimum utilisation rates in a very quick period of 3-4 months post operationalisation.

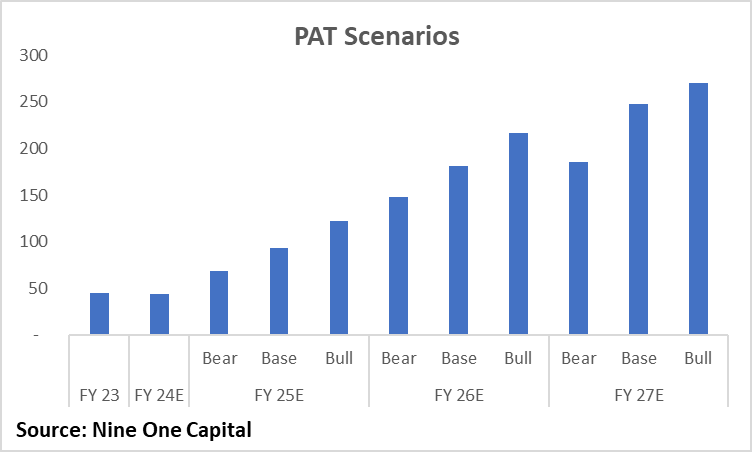

Profitability wise, based on my bear-to-bull case scenarios, the company is poised to make upwards of 50% ROCE on these new lines. The product is highly scalable even further with significant scope to add more capacity to meet growing domestic demand as well as to cater to export markets.

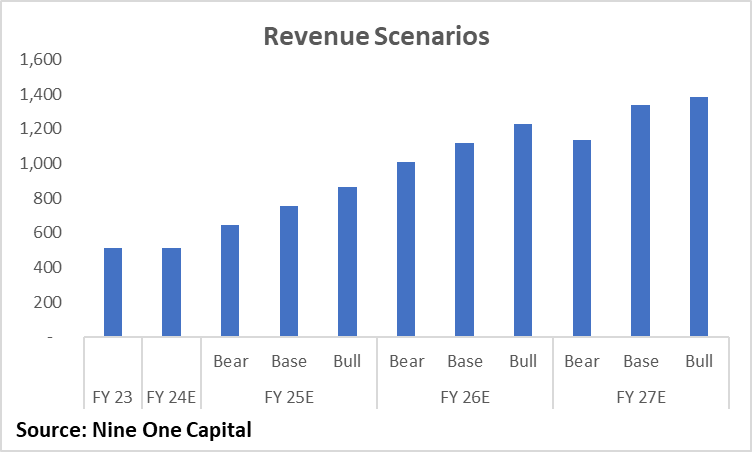

In terms of revenue and PAT estimates for the next three years (FY25 to FY26), the below charts capture my bear case to bull expectation for revenue and PAT:

As shown above, in my base case, I expect FY27 revenues to be 2.6x of FY24 revenues while due to operating leverage and due to changing mix to better profitability business, PAT is expected to grow 5.5x from FY24 levels. Now obviously market is discounting some bit of this and that's why on a trailing basis the stock will look expensive. Even in my bear case, the earnings are expected to grow 4x providing a sufficient margin of safety with a decent upside. If the company is able to execute well and walk the talk, the company can command a billion USD valuation and hence be potentially a 4-5x of current market prices.

If you wish to know more about our services, please feel free to write to us at gaurav.a@nineonecapital.in