We wrote a twitter thread on Whirlpool in Dec 2021 when a large PMS fund was selling its stake. At that time, even though, the company's stock was down in the otherwise bull market and many well-known investors were recommending buying into the weak stock, we argued that the risk-reward was not favourable and one should stay away from the stock.

Since then, the stock has been down around 33% with revenue growth as well as margins, both taking a hit. We try to evaluate the risk-reward again in light of the initiatives that the management has mentioned in their investor presentations and see whether it makes sense to buy Whirlpool India at the current market prices. With this article, we also try to showcase our scenario building framework that we employ before we decide to invest or not invest in any company.

Currently sluggish revenue growth and lower margins are a function of the high competitive intensity, in general slowdown for consumer durable products (as evident from Q3 results of these companies) and hence an inability to pass on the raw material inflation to their consumers which is why EBITDA margins have been lower than their historical averages.

As an investors when investing in companies which are currently not doing so great (that's why we are looking at Whirlpool), there are generally two sets of believes that one can have - 1) the status quo will prevail meaning revenue growth and margins will be low or 2) the currently difficult time period will improve and these companies will be able to grow at the double digit growth rate that they used to grow in the past and their EBITDA margins will also improve to historically high numbers.

If one takes a former view, one needs a severe bear market for you to buy any stock since one cannot see any upside with these bearish forecasts. In the latter case, all the companies which are not doing well will start looking appealing since future numbers will look way better than the present and at depressed valuations (hopefully), these will look appealing.

The realty lies somewhere in between. As an outsider (or even for that matter an insider), you don’t know the future. You don’t know whether the revenue growth will come back or not. You can't say that the EBITDA margins will go back to their long-term averages in the next 3 years. What one can do is to see the risk/reward in different scenarios. This means you would try to access the quantum of loss (risk) if one buys at the current prices and bad cycle continues to prevail and quantum of profit (reward) if one buys at CMP and things start to improve.

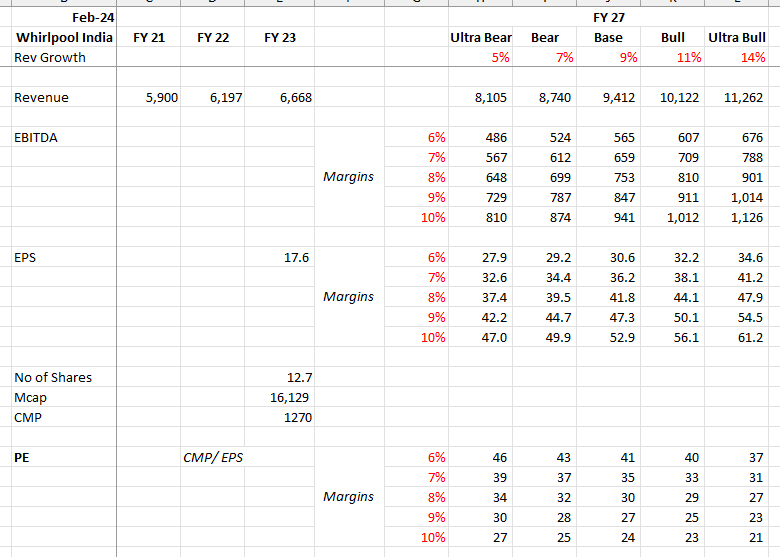

We will try to access the risk/reward for Whirlpool India under various assumptions and then see what kind of downside/ upside does the current stock price offer. We will try to see how FY27 (3 years from now) would look like in terms of revenue and PAT under different revenue growth and EBITDA margin assumptions that capture our bear case to bull case scenarios. Below are the assumptions that we take to arrive at the key FY27 numbers:

To give some context to the above assumptions, we refer to the guidance given by the senior person of global Whirlpool, in its corporate presentation as shown below:

Using these assumptions, we arrive at the below numbers capturing revenue, EBITDA and EPS range thereon:

With this simple exercise, we notice that, even in the bull most scenario of company delivering a healthy 14% CAGR growth in revenue from FY23 revenue base and a massive 600 bps EBITDA margin recovery from the current levels, we arrive at an EPS of 61 Vs FY23 EPS of around 18. At the CMP of 1270, the company is trading at 20x FY27 bull most PAT.

From here, one can give various PE multiples to bear case to bull case EPS and see what kind of downside/ upside one can expect under various scenarios. We try to be conservative when giving PE multiples since if the stock is looking attractive under these multiples, it most certainly be better in the real life.

As shown above, even in the base case the risk/reward is not great if one buys Whilrpool India at the CMP while one can loose big amount of their capital if the bear case were to pan out and due to this the valuation multiples for the company de-rate.

To take one step further, we try to see what happens to absolute upside/ downside if for some reason the stock price crashes by 30% and for a brief period, we get a chance to buy Whirlpool India at around 900 vs the CMP of 1270.

As shown, the risk/reward for the stock becomes much better but still the downside is not quite comfortable in the bear cases. However, if the stock prices come down to 900 levels, we would be comfortable in start buying the stock and if it comes even lower, we can think of making whirlpool a bigger position. Obviously, it is also a function of the other available opportunities.

The point that we are trying to make is that when you do this exercise for all the portfolio companies as well as for the companies that are in your pipeline, you can take a much better-informed decisions about your portfolio stocks and their respective weightages.

Probably at 50% lower prices, it will be a no brainer to invest in Whirlpool India where even in the bear most case, you can expect not to lose money while in the base to bull case you can hope to make a highly attractive investment IRR (shown below just for the sake of argument):

We don’t know whether the stock price will correct by 50% or not but we know that if it corrects that much, what would we need to do. Ultimately position sizing in cyclical companies is a function of risk/reward from the current market prices. The scenario analysis that is captured in this article, showcases our scenario framework that we run for all the companies which we research before we decide to buy or not to buy.