Markets in Turmoil: Finding Opportunities Amid the Chaos

While benchmarks show a moderate decline, the real pain is deeper and hence creating opportunities for bottom-up investors

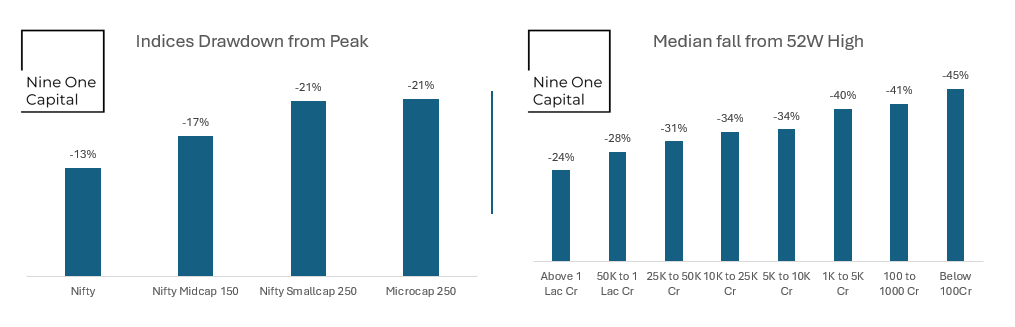

The past few months have been a stark reminder that markets don’t always behave as expected. While key benchmark indices have dropped 13–21% from their recent highs, the median stock has fallen closer to 40%, with smaller-cap companies bearing the brunt of the selloff. This divergence tells a deeper story that headline numbers fail to capture: the pain is far more widespread than it appears.

What’s Really Happening?

The market’s recent performance is a tale of two realities. On the surface, broader indices indicate a moderate correction. But underneath, the median stock has taken a severe hit, with smaller companies suffering even steeper declines.

Sectoral performance adds another layer to this narrative. Capex-heavy industries, which typically thrive on government spending and private investment, have significantly underperformed since the election results on June 4, 2024. The BJP’s less decisive mandate has shifted focus toward populist schemes, leaving infrastructure and heavy industries in the lurch. In contrast, sectors with limited government intervention such as IT and healthcare have held up relatively well.

The current market environment offers two crucial takeaways for the patient investor:

The pain is deeper than it appears – While benchmark indices suggest a moderate pullback, the reality is far harsher for individual stocks, particularly smaller-cap names. This widespread decline has created compelling opportunities to buy quality businesses at deeply discounted valuations.

Capex is down, but not out – Capex-heavy sectors have taken a hit, but this slowdown appears cyclical rather than structural. Over the medium term, both government and private sector investments will need to ramp up to sustain economic growth. Patient investors can find attractive entry points in these beaten-down industries.

As Howard Marks wisely put it, “The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.” Right now, fear dominates sentiment, and that’s precisely when opportunities emerge.

Our Approach: Head Down, Eyes Open

As Mark Twain quipped, “October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” Twain’s humor reminds us of the perils of speculation but also reinforces the importance of a disciplined, long-term approach.

At times like these, we believe in keeping our heads down and focusing on the fundamentals. Market dislocations create fertile ground for identifying undervalued businesses with strong long-term prospects. We’ve been actively scouting for high-quality stock ideas that can generate meaningful returns over a 3–5 year horizon.

This isn’t about trying to time the market, it’s about finding resilient businesses that can thrive despite short-term volatility. In particular, smaller-cap stocks present an attractive risk-reward balance for those willing to do the research and take a contrarian stance.

Conclusion

The current market selloff has created a rare opportunity for investors willing to look beyond the headlines. While the broader indices may suggest a moderate correction, the 40% median decline in stocks and even steeper falls in smaller caps. This highlights significant value waiting to be uncovered.

For us, this is a time to focus on bottom-up stock picking, particularly in beaten-down capex sectors, where a medium-term recovery seems inevitable. As always, patience and diligence will be the keys to unlocking value in this challenging environment.

So, while the market may feel like it’s in freefall, remember: the best opportunities often arise when everyone else is heading for the exits.

Stay patient, stay curious, and keep digging.

If you are interested in accessing our research and joining a network of informed investors, please contact us at Gaurav.a@nineonecapital.in

PS: Enjoy the Ind Vs Pak match today!