Shadows of the Past: The Governance Puzzle of a Newly Listed Company

Uncovering the hidden legacy of troubled promoters and the risks they pose to investors

A prominent promoter family has returned to the public market with ambitious plans in the defense sector. However, their past involvement in troubled ventures such as Mascon Global Limited and Secure Earth casts a long shadow over their new enterprise. This article explores their controversial history, the gaps in disclosure in their Red Herring Prospectus (RHP), and the implications for potential investors.

A Troubled Legacy

"The past is a map; the better we understand it, the more confidently we can navigate the future."

Patterns of financial mismanagement, a lack of transparency, and disregard for stakeholders can tarnish even the most promising new ventures. The family behind this newly listed company has left behind a trail of unresolved debts, opaque dealings, and questionable practices in their earlier businesses. A closer look at their involvement with Mascon Global Limited (MGL) and Secure Earth reveals a legacy that raises critical questions about their credibility and intentions.

Company 1: Mascon Global Limited (MGL): A Case of Corporate Mismanagement

Mascon Global Limited was once a promising IT and software services company. However, aggressive acquisitions and opaque financial practices led to its downfall. The company’s history is riddled with:

Questionable Transactions: Subsidiaries such as Anthem Technologies and E-businessware were sold or restructured without adequate shareholder disclosures.

Fraudulent Practices: Intellectual property and assets were transferred to entities like Secure Earth without creditor knowledge.

Unaddressed Liabilities: Massive debts, including ₹131 crore owed to SBI, were left unresolved.

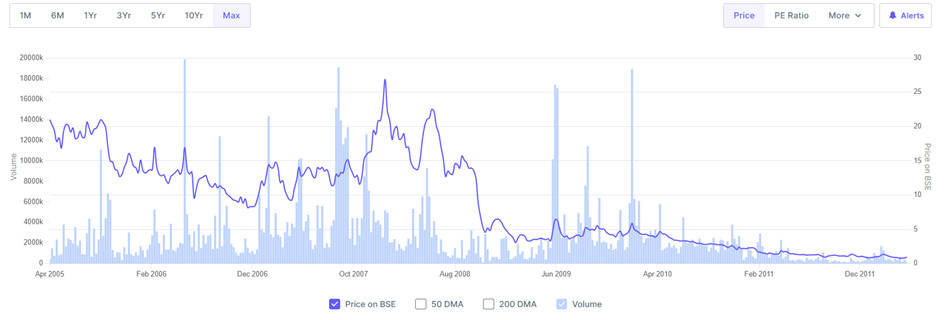

Mascon Global Stock Performance:

The Secure Earth Transition

Following MGL’s financial collapse, its assets and personnel were absorbed by entities branded as "Secure Earth." This restructuring appeared to strip creditors and stakeholders of any recovery value. For example:

BT Systems & Services, a subsidiary of MGL, became Secure Earth Technologies.

Secure Earth Health and Life Technologies inherited assets from Mascon Life Sciences without shareholder or creditor transparency.

Secure Earth Stock Performance:

If one wants to go into detail about Mascon Global and Secure Earth’s opaque financial dealings, we encourage you to refer to this blog: https://masconglobalsubsidiaries.blogspot.com/2015/07/

Red Flags on the recently listed company:

1) Hidden Involvement of Key Promoters: The erstwhile promoters of Mascon Global and Secure Earth, and the current promoters of the recently listed company have distanced themselves from the active management of the current company. Instead, their family members (mother and daughter) with no relevant industry experience have been placed at the forefront (interesting to note that the father and son now choose to stay away from the company as well as from the country).

2) Omissions in the Red Herring Prospectus: The RHP very conveniently misses to acknowledge or provide information about Mascon Global or about Secure Earth. This absence of transparency raises concerns of what else could be hidden in the closet as well as the sanctity of what is being disclosed.

3) Other factors: At the time of listing, SEBI ordered a financial audit due to concerns of raised by an investor; company publishing price sensitive information (PPT) in a private investor conference and not publishing on the exchange. We understand that these could be small concerns as compared to the ones highlighted above.

Conclusion

Evaluating a company on corporate governance is rarely a black-and-white exercise; it requires a nuanced approach that considers both the background of the promoters and their past and present actions. While no assessment can guarantee absolute accuracy, identifying red flags and understanding patterns of behavior can help avoid potential governance landmines. Steering clear of such pitfalls is as critical as identifying wealth-creating opportunities, as even a promising business can falter under questionable leadership. Ultimately, sound judgment, coupled with thorough research, is essential to navigate this complex terrain effectively.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. The analysis and opinions expressed are based on publicly available information and sources believed to be reliable but are not guaranteed for accuracy or completeness. Readers are encouraged to conduct their own due diligence or seek professional advice before making any investment decisions. The mention of specific companies, individuals, or events is not intended to defame or harm their reputation but to provide a factual and critical evaluation based on historical records and disclosures. Nine One Capital assumes no liability for any actions taken or decisions made based on the content of this article.