Thoughts on MDF Sector

Sector is going to witness one of the worst periods which will create opportunities for the patient contrarian investors

MDF segment in the overall wood penal space is a classic cyclical sector. In good times when all the industry players are making very healthy ROEs/ Margins, existing as well as new players announce capex plans. When all these capex operationalise, the entire industry goes through a terrible supply glut which results in sub-par profitability or losses.

For starters, MDF (Medium Density Fibreboard) is a wood penal board which is different from plywood in the sense that it is largely used by furniture OEMs and sophisticated carpenters. Globally, MDF is a preferred wood penal product for furniture manufacturing while in India, traditional plywood is still dominating which is changing towards MDF. This shift will lead to superior growth of the MDF sector in India.

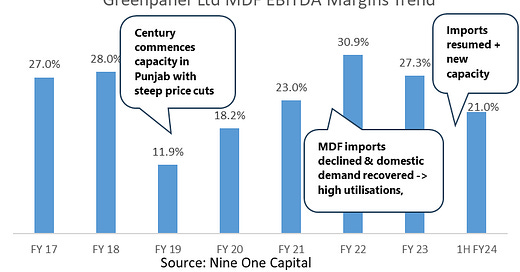

I believe MDF sector will see a similar bad period or worse as was witnessed in the last bad cycle of 2019 to 2020 period. During this bad period, a lot of new capacity from existing players (Action in the North, Rushil & Greenpanel in the South) and new players (Century in the North) came on board. Century in order to gain market share played the price war game in the North which led to the margin collapse of existing MDF player Greenpanel. In South India, higher capacity along with heavy MDF imports worsened the situation further.

Since the underlying demand for MDF was healthy due to the shift from plywood, the demand for MDF increased and thanks to Covid and supply chain disruptions, imports of MDF into India completely stopped which led to one of the best times for all the MDF players.

Fast forward to today, in the last 1-1.5 years all the existing players have announced big capex plans in MDF and a new player (Greenply) has also started its MDF facility in the West. Imports of MDF have also resumed and are now back to their 13-15% share which it used to be pre-covid (mean reversion remember?).

Refer to the EBITDA margin chart of Greenpanel Ltd which is a pure MDF play in India to get a context of what I am saying in the last two paragraphs:

What I believe will happen:

I firmly believe that the situation is going to get a lot worse in the next 1-2 years post which I believe will be a good time again waiting for MDF players. One should understand that cycles can sometimes extend and the timelines mentioned should not be taken as something cast in the stone. Here is how I believe the situation should pan out:

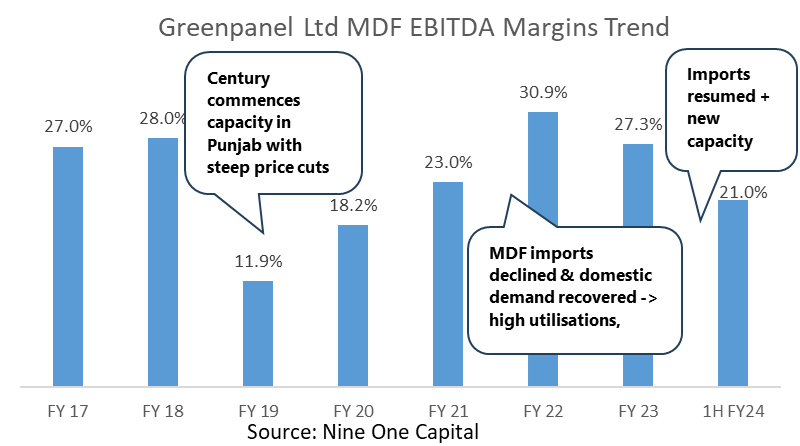

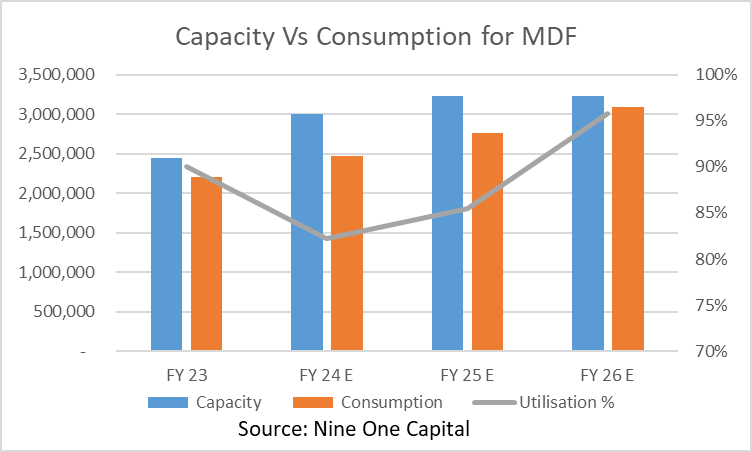

New capacity addition: From the end of the last financial year (March 2023), Indian MDF capacity will go up by 32% by the end of FY25 (2 years) while the demand growth has been around 10-12%. This would mean that during the interim period, all these capacities would not be utilized fully while all the operating costs, financing costs, and depreciation would hit the P&L.

Greenply cutting prices to gain market share: This is what I call the second-order impact. New players will cut prices to gain market share and build their brand (Greenply already announced price cuts in the South). While incumbents will be forced to cut prices in order to save their market share and maintain their existing high utilisations. This will result in sub-par margins as was seen in the FY19-FY20 period.

Cyclically high Raw Material inflation: Timber (one of the key RM for the wood penal industry) is currently going through one of the worst periods where the availability of plantations is becoming an issue due to weather issues and due to farmers switching off to some other crop varieties due to sub-par profits in 2018 to 2020 period (crop takes 3 years. This will keep the RM cost high for all the players leaving no cushion for EBITDA margins to sustain. However current sowing data indicates healthy farmer interest which would lead to high availability of timber and lower prices 2-3 years later.

Imports coming back to where they were: MDF imports in India became virtually zero during the FY21 to mid of FY23 period due to COVID-19 and supply chain disruptions. Imports have again resumed and are now back to their pre-covid levels. As per channel checks, imported MDF prices are 15-20% cheaper than domestic. MDF imports into India are largely from Southeast Asian countries such as Vietnam, Thailand, and Myanmar. I am not quite aware of the supply-demand dynamics of MDF in these countries and hence it is tough to make a view on imports of MDF into India. One thing that can happen is that during the bad times for domestic MDF manufacturers, Gov can introduce some duty on MDF imports which will bring parity to imported and domestically manufactured MDF. Another development here is BIS standard applicability to imported MDF which will increase imported MDF prices.

All the above-mentioned four factors will hit the domestic MDF players simultaneously. This would mean pressure on the utilisation rates, margins and hence depressed profitability for the MDF manufacturing companies.

Outlook beyond the next two years of tough period:

The good thing is that MDF demand in India is growing at 10-12%. This means that in 2-3 years, the 32% incremental capacity (announced so far) will get absorbed as shown in the chart below:

Further, 3 out 4 above-mentioned factors (except imports) will turn favorable in FY26/ FY27 (assuming no other major capex announcement in this period) which will again lead to good times for all the MDF players. As shown in the chart above, utilisation levels will inch to 95%+. This will lead to pricing power with the manufacturers with the benign raw material cycle of timber leading to better margins and hence superior profitability. A new capacity takes anywhere about 18-24 months to operationalise and typically industry players wait for 2-3 good quarters before commencing with new set of capex plans.

What to do with all this information:

The current valuations of MDF players do not reflect the pain the sector is going to witness. I am hopeful of a steep correction in the stock prices of MDF players as the bad cycle starts to reflect in reported financials and then I will be a buyer at a price for these MDF players.

HI Gaurav, I enjoy reading your blogs ... Would you have a framework for the cyclical companies? when do you actually decide on buying the companies? For e.g - on Greenpanel, assuming they start showing losses, at what valuations would you buy? This is more for understanding rather than taking a call on Greenpanel. Thanks Rahul Kumar