Update on PFC and REC

PFC and REC are trading at attractive risk-reward for the growth and profitability that they offer

We have been holding PFC and REC in our core portfolio since Dec 2022 and both the stocks have generated substantial returns for us. We covered both the companies in our twitter (now X) thread (link). In this post we wanted to write our thoughts on both the companies, risk-reward that we see at the current prices and also why we continue to remain bullish on these two companies.

In December 2022 when we invested in PFC and REC, our investment rationale was to have a high dividend yield that was prevailing which we believed to be sustainable as well as increasing along with an optionality to play the power sector which was in the bad shape for 10+ years. We are always on a lookout for sectors which are doing bad but where structurally there is no disruption. Power sector is one such sector where we have been bullish since 2021 and we continue to remain bullish on this sector.

What we thought was a dividend yield play turned out to be a growth story owing to various power sector reforms and capacity expansion plans form the industry. Additionally, change in perception for PSU stocks led the stock prices for these two NBFCs to go up by 3.5 to 4x (excluding healthy dividend payments) since our twitter thread.

As we stand today, PFC and REC both are now looking to grow their loan book meaningfully. Before getting to the numbers, we share a few points that summarise our thesis on PFC and REC:

Visible double digit loan growth: Owing to various reforms and capex, both the companies have guided for a good loan book growth visibility over a medium term. While PFC has guided for a 15% loan growth, REC management has guided for 20%. We believe 15% is also a very healthy growth to have over a 3–4-year period with superior profitability metrics.

Diversified liability mix to protect NIMs: Both the companies have highly diversified liability mix and are not dependent upon banks to finance their loan book growth. Further the kind of NIM pressure which banks are facing due to rise in their deposit costs, for PFC/REC a bulk of deposits are already at a higher end of costs and hence the current NIMs are expected to be sustainable.

Stressed assets resolution: Past stressed assets are also getting resolved which is throwing write backs of the excess provisions that these companies made in the past.

Healthy ROEs: Due to good growth, sustaining NIMs, low operating cost model and benign credit cost, ROEs for both the companies are expected to be at a very healthy level of above 20%.

A good play on power sector capex and reforms: Looking at other companies which benefit from the power sector reforms, we find PFC/REC to be available at a very attractive price while offering a very good exposure to the power sector cycle. These companies have also expanded their offering to Infrastructure sector which is again coming out of a long period of bad cycle.

Renewable energy exposure: There is a huge thirst towards renewable energy with massive capex being announced by PSU as well as private players. Both PFC/REC have guided for a very healthy pipeline for this segment.

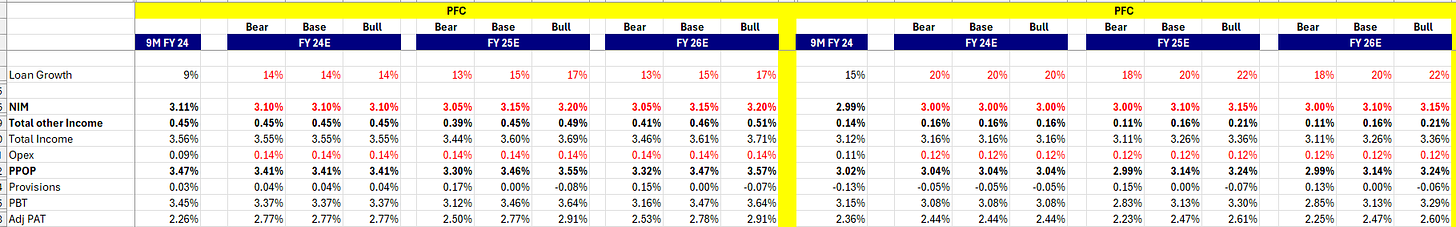

As our readers know, we don’t believe in creating one forecast for any company. We rather create multiple scenarios that capture bear case to bull case and then we try to see how much money we can lose if the bear case prevails and how much do we stand to gain if base to bull case prevails. For PFC and REC, we use below assumptions for our bear to bull case scenarios:

One can argue that the provisioning that we are taking even in our bear case is lower than the past and hence the bear case is not conservative enough. Our reply to this would be that the bear case doesn’t need to be negative just for the sake of it. We are in the environment where stressed assets are getting resolved and we are still some time away from the next NPA cycle.

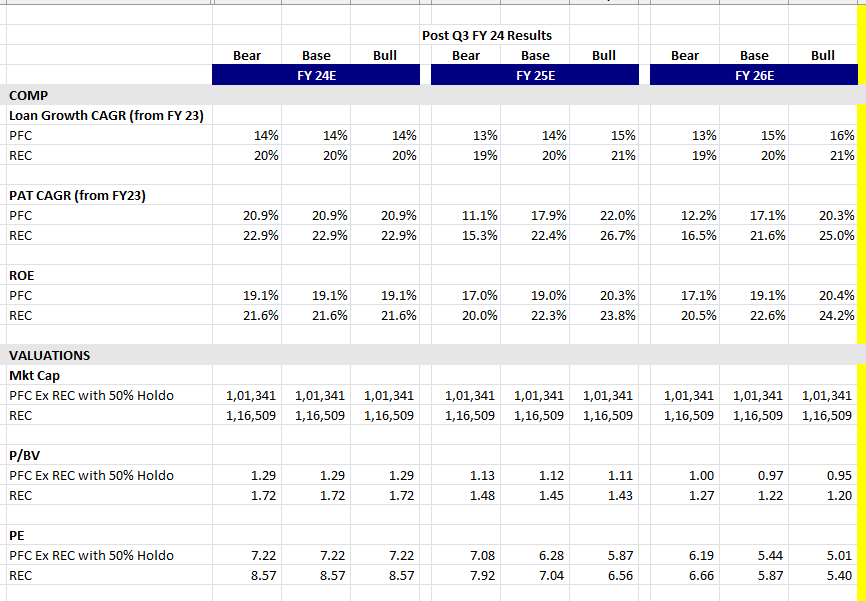

Putting the above-mentioned assumptions into our model yield us the below output:

As shown, PFC and REC are still available at attractive valuations for the kind of earnings growth and profitability (ROE) that they offer. We continue to believe that with power sector will see a lot of more reforms and capex in the next 5 years. Considering the valuations and growth that PFC and REC offer, we believe both of these companies are the best way to play the power sector upcycle. In our portfolio that we share here, we hold both PFC and REC.

Disclaimer: The above-mentioned views are for the information purpose only. We advise our readers to consult their financial advisor before deciding to invest in the stocks mentioned in the article. We hold PFC and REC in our portfolio.

Have read your past post. Nice. I don't think anyone out there studied PFC and REC and made a call on it. Also your heads I win big and tails i don't lose much valuation way is known around but very little followed.